1. Introduction: Understanding Momentum Algo Pro

Momentum Algo Pro (MAP) isn't just another investment platform—it's a blend of cutting-edge AI technology and strategic investment techniques designed to generate consistent returns. MAP's focus on regulated brokerage accounts, transparency, and risk management makes it a standout in the world of algorithmic trading. But how does it actually perform in practice? In this review, I'll share my personal experience with Momentum Algo Pro, diving into the details that matter most to potential investors.

2. My Experience with Momentum Algo Pro: A First-Person Review

From the moment I signed up with Momentum Algo Pro, I was struck by how seamless the onboarding process was. The platform’s interface, though powered by sophisticated algorithms, was surprisingly intuitive. It didn’t take long for me to feel comfortable navigating through the various tools and features.

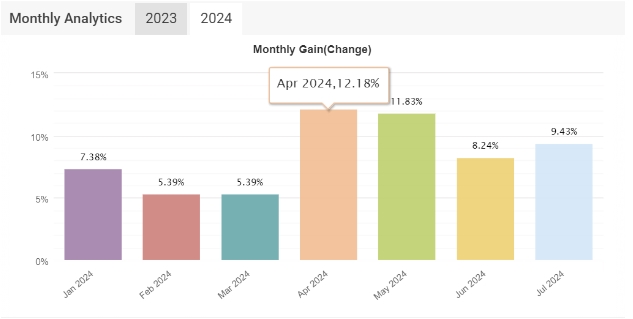

What truly set MAP apart for me was the transparency. I had full access to live trading data and third-party verifications, which offered a layer of trust and accountability. My initial investment felt secure, and I could monitor its growth in real-time. Over the months, I observed a steady increase in my portfolio, which was impressive given the market volatility at the time.

One of the standout features for me was the conservative risk management. The platform’s use of stop-loss protocols provided peace of mind, knowing that my potential losses were capped. Additionally, the diversification of strategies across different asset classes ensured that my investments were not overly exposed to any single market risk.

However, it wasn’t all smooth sailing. There were moments when the market shifts led to slower growth than I had anticipated, but the platform’s algorithmic adjustments always seemed to correct the course. This level of responsiveness made me confident that my investments were in capable hands.

Yet, what truly solidified my trust in MAP was the way it handled market downturns. During a particularly volatile period, I watched as other investments outside of MAP suffered significant losses. But MAP’s algorithms adjusted dynamically, reducing exposure to riskier assets and reallocating resources to more stable opportunities. This adaptability reassured me that MAP wasn’t just about chasing profits—it was about preserving capital and ensuring long-term growth.

The communication from the MAP team also played a critical role in my positive experience. Regular updates, insightful market analysis, and prompt responses to any inquiries made me feel like I was more than just another investor on the platform. The personalized attention I received gave me confidence that my financial goals were aligned with the platform's strategies.

3. Is Momentum Algo Pro a Scam? Addressing the Concerns

With any investment platform that promises advanced strategies and substantial returns, skepticism is natural. So, is Momentum Algo Pro a scam? Based on my experience, I can confidently say that it is not.

The platform’s commitment to transparency is evident in every aspect of its operations. From regulated brokerage accounts to third-party verifications of trading results, MAP goes above and beyond to ensure that its practices are both legal and ethical. Additionally, the platform’s focus on risk management and conservative trading strategies further reinforces its credibility.

I’ve also seen firsthand how MAP handles client funds with care, using established, regulated brokerage firms to manage accounts. The level of transparency provided, especially through external auditing and third-party verification platforms like myFXBook, adds a layer of trust that many other platforms lack.

While no investment is without risk, MAP’s commitment to regulatory compliance, ethical practices, and transparent reporting mitigates concerns about fraudulent activities. If you're worried about potential scams, I recommend doing thorough research and reviewing available information, just as I did before investing.

4. Sal Habibi’s Influence on Momentum Algo Pro

Sal Habibi’s vision and expertise are at the core of Momentum Algo Pro. His approach to algorithmic investing, grounded in transparency and technological innovation, is evident throughout the platform. Sal’s emphasis on making high-level investment strategies accessible to a broader audience, while maintaining a selective client base, resonated with me. His leadership instilled a sense of trust, and I appreciated his commitment to ensuring that investors like myself could benefit from advanced trading strategies without being overwhelmed by complexity.

5. Exploring Other Investment Options: How Does MAP Compare?

While Momentum Algo Pro has been a strong performer in my portfolio, it's worth noting that other algorithmic trading platforms also offer similar services. Platforms like QuantConnect and Interactive Brokers have their own unique approaches to algorithmic trading. However, I found that MAP’s blend of AI-driven strategies and human oversight provided a more balanced and secure investment experience. For those looking for a more hands-on approach, these alternatives might be worth exploring, but for investors seeking a balance of automation and security, MAP stands out.

6. Conclusion: Is Momentum Algo Pro Worth It?

After several months with Momentum Algo Pro, I can confidently say that the platform delivers on its promises. The combination of advanced technology, strategic risk management, and Sal Habibi’s leadership creates a robust investment environment. While no investment is without risks, MAP’s transparent and methodical approach helps mitigate those risks effectively. For investors looking to explore the world of algorithmic trading, Momentum Algo Pro is a compelling option that has proven to be a reliable and profitable addition to my investment portfolio.